Business

FTSE 100 passes 10,000 point milestone for first time, after best year of gains since 2009 – business live

Posted on Friday January 02, 2026

Rolling coverage of the latest economic and financial newsThe UK’s manufacturing sector grew at its fastest pace in 15 months in December, according to the latest reading from S&P Global’s purchasing managers’ index.The index rose to 50.6 in December, up from 50.2 in November, but below an initial reading for December of 51.2.The start of 2026 will show if growth can be sustained after these temporary boosts subside.The base of the expansion needs to shift more towards rising demand and away from inventory building and backlog clearance. December’s interest rate cut will hopefully play some part in assisting this transition, encouraging manufacturers and their customers to increase spending and investment. Manufacturers remain uncertain on this score, with business optimism falling for the first time in three months in December.Previously, the fastest jump in blocks of 1,000 happened when the FTSE 100 went from 5,000 to 6,000, which took 229 days in the late 90s.The longest period was 6,206 days between hitting 6,000 in March 1998 and 7,000 in 2015. Admittedly, that period included a global financial crisis, so it was unusual times.”Investors have faced considerable uncertainty, and many have looked away from the US for opportunities. They’ve focused on cheaper areas of the market, of which the UK is one.…We’ve seen increased interest from foreign investors looking to diversify their holdings and the FTSE 100 has also shone during the more tumultuous periods thanks to its plethora of defensive-style companies. Continue reading...

Brighton’s historic Palace Pier up for sale as tourist numbers fall

Posted on Friday January 02, 2026

BPG hopes to find buyer for Grade II-listed structure by the summer after slump in profits and rising costsBrighton’s historic Palace Pier has been put up for sale after a decline in tourist numbers, a drop in profits and increase in costs in recent years.The leisure group that owns the 126-year-old structure, which has appeared in famous films including Brighton Rock and Quadrophenia, said it hoped to find a new owner by the summer. Continue reading...

UK house prices unexpectedly fell at end of year, Nationwide says

Posted on Friday January 02, 2026

Average property price drops by 0.4% in December to £271,068 after forecasts of 0.1% month-on-month riseBusiness live – latest updatesUK house prices unexpectedly fell in December, according to a top mortgage lender, with the market finishing the year with the weakest annual growth in more than 18 months.The average property price slumped by 0.4% to £271,068 when compared with November, according to Nationwide, confounding City forecasts of a 0.1% rise. Continue reading...

Opinion

What if floods left your home unsellable? That’s the reality facing more and more people in Britain | Kirsty Major

Posted on Friday January 02, 2026

The hill I will die on: PDAs on the morning commute are never acceptable | Michael Akadiri

Posted on Friday January 02, 2026

The best way to get round a difficult problem? Do nothing about it | Gaby Hinsliff

Posted on Thursday January 01, 2026

From bon appetit to Uber Eats: why France’s beloved restaurants are in crisis | Paul Taylor

Posted on Friday January 02, 2026

What is Keir Starmer doing to push back the populists? Not nearly enough. We have a plan to take them on | Chris Powell

Posted on Thursday January 01, 2026

Ignore the sceptics: with this new vaccine, chickenpox could become a thing of the past | Wes Streeting

Posted on Friday January 02, 2026

When racists shout ‘Go home’, and you come from 15 places, what to do? | Hugh Muir

Posted on Thursday January 01, 2026

I’ve been a New Yorker for 23 years. Today Zohran Mamdani’s swearing-in makes this city a real home | Mona Eltahawy

Posted on Thursday January 01, 2026

Sign up to Matters of Opinion: a weekly newsletter from our columnists and writers

Posted on Thursday June 26, 2025

At the turn of the year, I’m facing a pivot point. Midlife crisis? No thanks | Emma Brockes

Posted on Thursday January 01, 2026

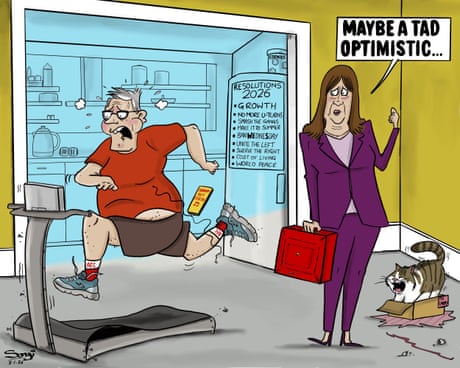

Pete Songi on the UK government’s new year’s resolutions – cartoon

Posted on Thursday January 01, 2026

The Guardian view on mRNA vaccines: they are the future – with or without Donald Trump | Editorial

Posted on Thursday January 01, 2026

Technology

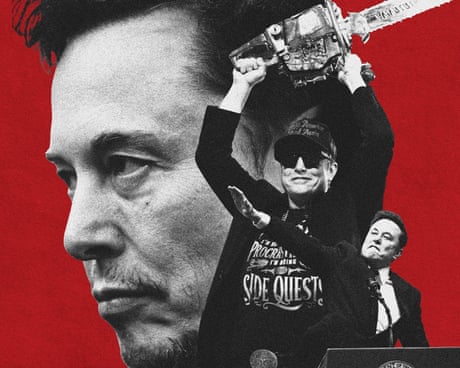

‘They sowed chaos to no avail’: the lasting legacy of Elon Musk’s Doge

Posted on Thursday January 01, 2026

The billionaire – who had no government experience – left various federal agencies in disarray while overseeing an ‘efficiency’ drive across WashingtonAs Elon Musk, the world’s richest person, splurged more than $250m on Donald Trump’s 2024 re-election campaign, the US president commissioned his new ally to oversee a sweeping “efficiency” drive across the federal government.The Tesla and SpaceX boss, who had no experience inside government, was tasked with eradicating waste and cutting spending as part of the so-called “department of government efficiency” (Doge) – and was quick to stoke expectations. Continue reading...

Elon Musk’s 2025 recap: how the world’s richest person became its most chaotic

Posted on Wednesday December 31, 2025

How the tech CEO and ‘Dogefather’ made a mess of the year – from an apparent Nazi salute during his White House tenure to Tesla sales slumps and Starship explosionsThe year of 2025 was dizzying for Elon Musk. The tech titan began the year holding court with Donald Trump in Washington DC. As the months ticked by, one public appearance after another baffled the US and the world. Musk appeared to give a Nazi salute at Trump’s inauguration, staunchly championed a 19-year-old staffer nicknamed “Big Balls,” denied reports of being a drug addict while advising the president, and showed up at a White House press conference with a black eye – all in the first half of the year alone.“Elon’s attitude is you have to get it done fast. If you’re an incrementalist, you just won’t get your rocket to the moon,” Susie Wiles, Trump’s chief of staff, told Vanity Fair in an expansive interview earlier this month. “And so with that attitude, you’re going to break some china.” Continue reading...

Sport

The Guardian Footballer of the Year Jess Carter: ‘I remember not wanting to go out’

Posted on Friday January 02, 2026

England defender publicly confronted racist abuse at the Euros and ended 2025 a title winner with club and countryThe Guardian Footballer of the Year is an award given to a player who has done something remarkable, whether by overcoming adversity, helping others or setting a sporting example by acting with exceptional honesty.Jess Carter has spent her life grappling with when to hold back and when to speak up; wrestling with being naturally herself, embodying the characteristics her parents instilled in her of being open, honest, vocal and confident, and subduing herself because, while society values those traits, in a black woman they can be viewed negatively. Continue reading...

Chelsea manager latest, transfer updates and more: football news – live

Posted on Friday January 02, 2026

⚽ Read Jacob Steinberg on Maresca’s Chelsea departure⚽ Fixtures | Tables | Follow us on Bluesky | Email TahaWho was at a game yesterday? Commiserations to those at the Gtech Stadium for that Brentford-Spurs stinker, and Liverpool v Leeds wasn’t exactly a barrel of fun either. Sunderland (and Arsenal) fans will have enjoyed their own stalemate rather more though. Meanwhile Ipswich are coming up on the rails in the Championship promotion race and Bristol City filled their boots in a 5-0 romp against Portsmouth.Here’s some accounts of yesterday’s action: Continue reading...